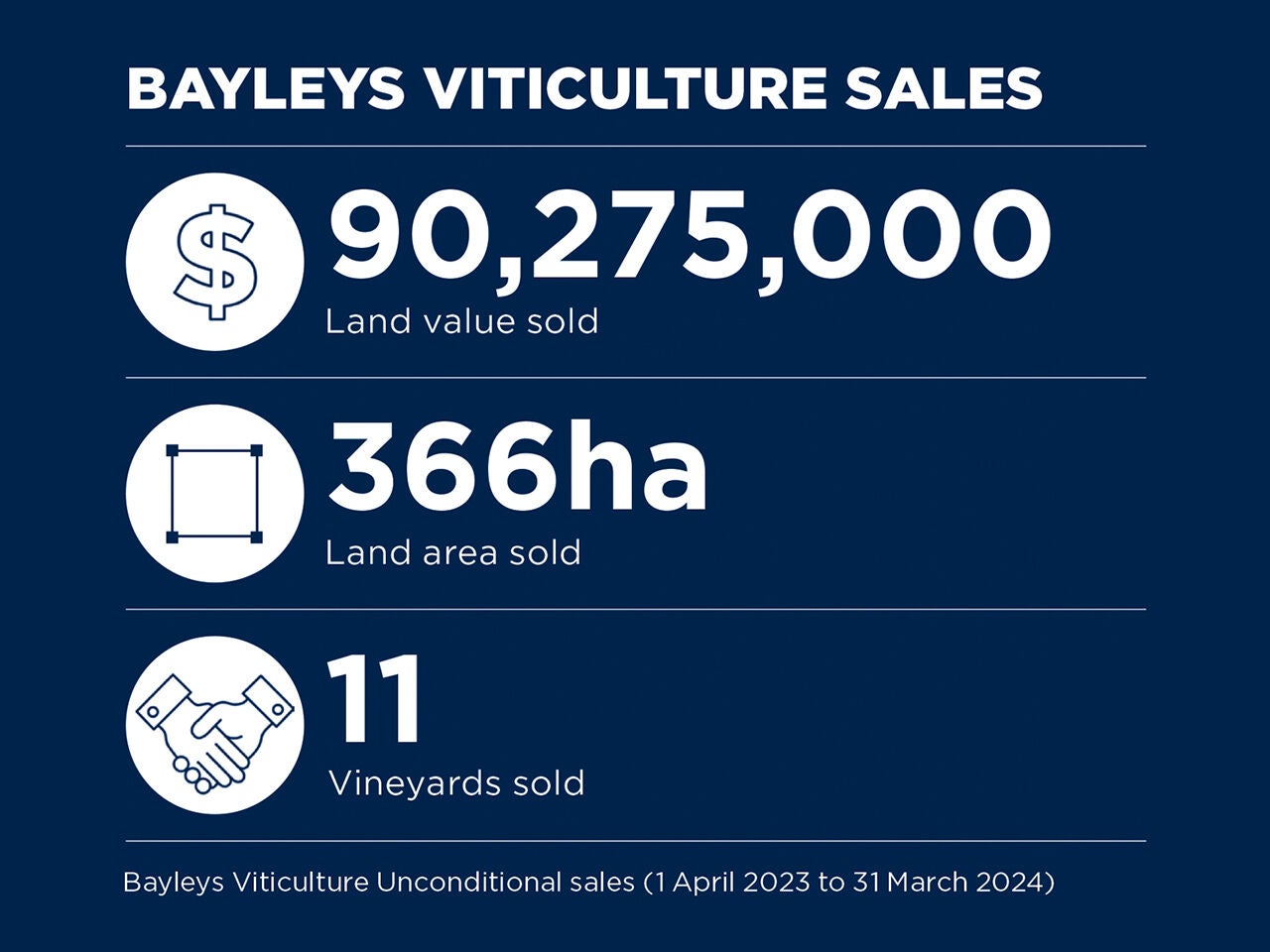

Rural Insight -

Rural Insights Viticulture

Biggest trends

Sauvignon Blanc will remain the main cash cow

With yields being down this season it has meant one of the best vintages in sometime with the fruit picked reported to be exceptionally good. Supply has finally caught up demand, putting pressure on price and recent inflated cost has seen margins reduce. Sauvignon Blanc is expected to remain the main cash cow as global markets recalibrate their stock levels.

Contracted supply is an influencing factor

Vineyards with contracted supply agreements are now favourable for vendors as it provides security of offtake given reduced demand for grapes in the market. Previously, uncontracted vineyards were favoured as parties needed certainty of production to meet market demand. Strength of counterparty, contract tenure and terms are all important considerations.

Vine replacement a focus

Many vineyards are now approaching 30 years and where production is becoming uneconomic, growers have a preference to redevelop or ‘refurbish the asset’ with new plantings. CapEx and/or operational advantages are key considerations, particularly where vines have tighter spacing and there are productivity gains. Vine availability is expected to be tight and require extended lead times.

Outlook for the next 12 months

Rebalancing of export markets to occur

Export orders are starting to show signs of a lift in volume following a period where a shortage in supply to meet global demand eventually resulted in overordering and stockpiling occurring. Consumer demand is expected to stabilise and balance out the supply chain.

Hands off investment will remain attractive

Given the relatively scalable and systemised nature of vineyards, it provides opportunity for a wider investor pool. Contract management remains competitive and provides opportunity for smaller through to corporate buyers, as they adjust to a higher cost of debt environment. The adjustment in fruit prices has seen investors make price adjustment in the immediate term. Scarcity of available land remains a key driver underpinning investment in the longer term presenting opportunity for buyers in the shorter term.

Lifestyle purchasers will remain persistent

Activity from lifestyle purchasers is expected to remain, particularly in the $2.5M to $5.0M price range. The opportunity to generate passive income alongside the lifestyle amongst the vines will continue to appeal to those searching for a home and supplementary income.