Total Property -

Industrial sector gamechangers

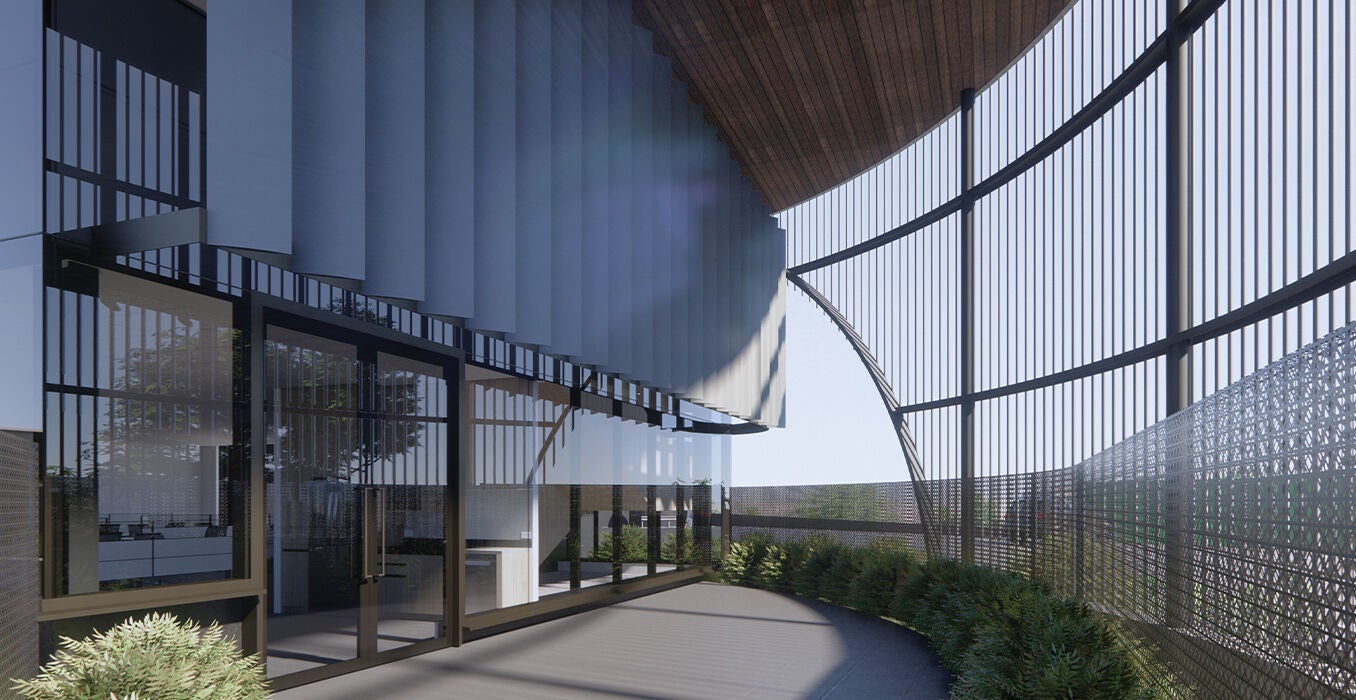

Argosy Property's Mt Richmond development

The Fourth Industrial Revolution – or 4IR – the data-driven world view that is transforming the global economy is upon us – so what does this mean for industrial property?

The industrial property sector has effectively shrugged off its formerly utilitarian and grungy image to become a high-value, sought-after and well-performing asset class that is at the forefront of technology integration and innovative design, and heavily onboard with sustainability and green initiatives.

An EY study undertaken in South and North America found 40 percent of supply chain organisations are investing in generative artificial intelligence (GenAI) to assist them in planning, sourcing, making, and moving.

While uptake of certain new technologies – like fully automated driverless trucks to seamlessly transfer goods between major freight hubs – might be some way off in New Zealand, intelligently automated warehousing solutions for quick and accurate picking, packing, processing and dispatching are here.

For some businesses, bigger is better. NZ Post’s recently opened processing facility in Wiri is the size of four football fields and has more than doubled its processing capacity to 30,000 parcels per hour thanks to automated technology.

NZ Post’s e-Commerce Market Sentiments Report 2024 showed that delivery experience contributes 14 percent to a shopper’s choice of retailer and with around 10 percent of New Zealand retail transacted online, and expected to continue growing, having a resilient delivery chain is essential.

As evidence that the world is becoming more interconnected, and that the cost of living is biting for consumers, Chinese e-commerce business Temu is now rated by 17 percent of New Zealanders as the online retailer they used the most.

At the coalface

Bayleys national director industrial, Scott Campbell says although New Zealand is a small drop in a very big ocean when you look at industrial operations globally, we are integrating innovation into workplaces and business activity and do compete on asset quality.

“We are seeing the adoption of artificial intelligence algorithms and mechanisms to revolutionise logistics operations. This is resulting in the uptake of hyperlocal delivery models, the integration of electric vehicles into delivery fleets, and technology to optimise delivery routes.”

The development sector’s response to a changing large corporate environment has been entrepreneurial, creating flagship industrial buildings that are revolutionising the way New Zealand businesses operate.

“This is not a matter of jumping on a bandwagon – it’s a strategic and very deliberate move by developers to create assets that are set up for long-term success, and which meet the goals and expectations of discerning stakeholders and operators.

“Cleverly designed and tech-enabled industrial buildings allow occupiers to be more flexible and responsive to changing market forces, thereby ensuring their operations are resilient and adaptable to whatever is thrown their way.”

Campbell says five years ago, only around five percent of Bayleys’ industrial occupiers were talking about the integration of robotics into their business operations and factoring this into their real estate decisions. Today, that figure is around 50 percent.

“Technology can become obsolete and superseded very quickly so flexibility within physical space footprints is crucial. Many occupiers still only play the ball in front of them but technology and automation is advancing rapidly so to remain relevant in the marketplace, businesses will need to be more visionary and the big names in the market are definitely playing the long game.

“We’re seeing demand for heavier floor loadings and stud heights to accommodate more sophisticated racking systems and specialised machinery that needs to be bolted down. “Market leader in the fast-moving consumer goods sector, Cardinal Logistics’ third-party logistics warehouse in Drury is the country’s first fully automated, ‘always on’ 3PL facility, and believed to be the largest of its type in the southern hemisphere.”

Sustainability is also high on corporate and developer agendas with new builds embracing best-practice green philosophies and solutions, with solar panels, water re-use, and efficient ventilation and lighting.

“Realistically, there’s not more that can be incorporated on the sustainability side when we’re talking about industrial,” says Campbell.

“Stakeholder interests and ESG mandates are largely dictating the green requirements, and this is particularly true for global corporates.”

Looking ahead, Campbell says we should expect further growth in the country’s data centre sector given digital transformation and the need for data sovereignty, adding that thanks to our renewable energy sources, New Zealand is held above our global peers in this space.

The cold chain logistics sector will also expand off the back of population growth and the surge in online grocery shopping, food delivery services and demand for pharmaceuticals.

He notes that A.P. Moller-Maersk (Maersk) is leading the way with its state-of-the-art, integrated cold chain facility at the Ruakura Superhub in the Waikato.

“Something else to watch for is automated vertical farm production, where plants are grown in temperature and light-controlled warehouses. This would potentially free up more land for housing and help safeguard the supply of fresh produce in the face of severe weather events.”

Market snapshot

Bayleys’ latest industrial property report shows a number of factors at play in the current market, with vacancy rates edging up as occupiers right-size footprints and realign their real estate needs.

“There’s been a rise in sub-lease space available, along with more activity from well-capitalised owner-occupiers who are buying premises for security of tenure and to mitigate rising rents.

“While land prices are stabilising and yields are settling at higher levels, rents are still on the rise,” says Campbell.

Bayleys associate director Auckland industrial, Greg Hall says along with the trend towards more sustainable buildings and practices, there’s been a marked change in office-to-warehouse ratios and a notable asset gap needing to be filled.

“The square meterage allocated to office use has definitely shrunk in the last five years. Warehouse cubic capacity is a huge driver, so space needs to be optimised.

“While the industrial pipeline is starting to progress now after a sluggish lull, and there does appear to be some development stock on the horizon, there is a distinct lack of ‘smaller’ 1,500sqm-2,500sqm footprint A-grade warehousing planned for.

“Property of this size acts as an incubator for medium-sized businesses who once they grow and gain momentum, will then transition to larger warehouses.”

Greening up a significant portfolio

Argosy Property, the NZX-listed and top 50 entity by market capitalisation, has a diverse portfolio of 50 properties worth over $2 billion across industrial, office and large-format retail, and a “green” portfolio worth $675 million.

Head of development, Marilyn Storey says Argosy intends growing the industrial component of the portfolio and greening this up.

“Argosy’s current industrial weighting is 51 percent and growth within our industrial development pipeline will increase this to over 60 percent, with the company target set between 60-70 percent.

“We’ve also mandated to have over 50 percent of our portfolio assets green-rated by 2031, with these developments targeting 6-Green Star ratings and low-operating carbon through the use of solar.”

With stakeholders championing ESG mandates, Storey says most of the offshore occupier enquiry has a sustainability requirement.

“In the sustainable space, New Zealand would be on par with Australia and Europe. The design quality of our buildings is excellent as we are delivering clear-span, seismically resilient buildings and incorporating climate adaptation into our design.

“We have an advantage in New Zealand with operating carbon, as our electricity grid produces a large amount of electricity from renewable energy sources.

“Our aim is to deliver a quality product driven by Green Star requirements to reduce environmental impact and improve building efficiency, while meeting occupier requirements for vibrant working spaces for their staff.”

Technology and AI are reshaping how buildings are designed, with Storey saying automation, robotics and layout optimisation all contribute to the efficient use of a warehouse and reduce operational costs.

“We’re constructing warehouses that future-proof space flexibility for occupiers. We maximise the height to the knee, make them column-free wherever possible to optimise capacity, increase floor loadings, and ensure there’s truck articulation around the site for efficiency.”

On a 3.5ha site in Neilson Street, Onehunga, Argosy’s largest industrial build to-date is underway. The $100 million-plus complex targets the 6-Green Star Design and As-Built rating, a world-leading sustainability standard.

This development comprises two high, clear-span warehouses up to 13m in knee height – one 5,000sqm, the second 11,500sqm, along with 3,400sqm of breezeway. It incorporates low-carbon concrete, rainwater harvesting, solar electricity generation via one of the country’s largest rooftop photovoltaic installations, smart lighting and air conditioning, and other green initiatives.

Similarly, Argosy’s Mt Richmond development in Mt Wellington on two contiguous sites totalling 10.64ha, is targeting a 6-Green Star rating across the project’s six warehouses. While watching global trends, Storey says vertical warehousing is not currently on Argosy’s agenda, although it’s pipeline could flex and pivot should demand arise.

“The lack of strategically located land and escalating rental rates are driving vertical warehousing in overseas markets. It’s more complex to build multi-level industrial property in New Zealand given seismic thresholds, and it’s not suitable for all tenants, but in time we could see vertical warehousing here.”

Argosy’s pipeline over the next eight years is primarily focused on industrial development in Auckland given its brownfield acquisitions in the past decade. Storey says it would only consider development outside of the Auckland region if it was driven by an existing tenant.

Upwards development

Bayleys’ global real estate partner Knight Frank identifies the importance of logistics facilities close to built-up urban areas for last-mile delivery efficiencies to meet consumer demand for same-day or next-day delivery, as a major driver in the Asia-Pacific industrial market.

The higher cost of land in tightly constrained urban locations translates to higher rents, so vertical warehousing is emerging to make a facility more productive and to offset land and construction costs.

Across the Tasman, Knight Frank’s national head of industrial logistics, James Templeton says vertical/multi-deck warehousing has been talked about for some time in Australia, however, it is only practical in certain very limited situations.

“Multi-storey warehousing exists extensively in places like Hong Kong, Singapore and some Japanese cities where land is very constrained, as well as in some port cities in Europe.

“Sydney is probably the only city in Australia with real land constraint issues given the local geography which limits growth in several directions. Industrial stock is in very tight supply due to a lack of available inner-city land and consequently, we see very high land prices – and rents.

“In South Sydney, rents are as high as $328/sqm – contrast this with average rents of $140/sqm in Melbourne – so multi-deck warehousing could be viable there and a few projects are expected.

“Outside of this scenario, and despite recent land values going up, the cost of land beyond South Sydney is too low and construction costs way too high to make multi-storey warehousing stack up right now – apart from in exceptional cases.”

Templeton says the shift from just-in-time to just-in-case dynamics brought about by the pandemic-induced supply chain disruption and rapid expansion of e-commerce, has been a major contributor to the boost in the price of warehousing across Australia.

“The increased requirement for storage for external supplies, and a move to onshoring in some areas has had a knock-on impact on industrial land values and contributed to rising rents.

“Bolstered by new development supply, some normality is now returning to industrial space requirements and vacancy rates following a period of extreme space shortages.

“That said, as pandemic-related factors have abated, other world issues like the Red Sea conflict and wider political unrest have maintained much of the requirement for extra inventory space.”

Templeton says while many occupiers appear to be ahead of the curve in future-proofing their industrial footprint and embracing automation, some are too far ahead with their space estimations resulting in some subleasing.

“However, more generally and more importantly for industrial property is the ESG story, which until now was most widely associated with the office sector.

“ESG-related design and strategy is being embedded into high-end developments to enable access to green capital, to help reduce operating costs, and to attract and retain quality tenants. It is also seen as future-proofing the investment credentials of an asset as regulations tighten.”